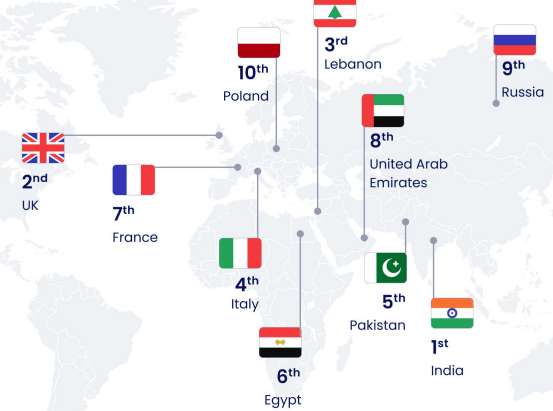

Dubai’s real estate market continues to break records in 2024, with foreign investors playing a key role in driving growth. According to a recent report by Better Homes, Indians maintained their top position as the biggest foreign property buyers in Dubai, while Pakistanis made a notable leap to fifth place, up from seventh last year.

Top 5 Nationalities Buying Property in Dubai

Here’s how the top rankings for 2024 looked among international buyers:

- 🇮🇳 India – 1st place

- 🇬🇧 United Kingdom – 2nd place

- 🇷🇺 Russia – dropped from 3rd in 2023 to 9th

- 🇵🇰 Pakistan – rose to 5th from 7th

- 🇹🇷 Turkey – entered top 10, replacing Poland

The changes in rankings reflect shifting global investment trends and rising interest in Dubai’s thriving real estate market.

AED 423 Billion in Property Sales: A Record-Breaking Year

Dubai’s property market achieved a major milestone in 2024, with the total value of real estate transactions reaching AED 423 billion. That’s a 30% increase in both transaction value and volume compared to 2023.

This remarkable growth shows strong investor confidence and continued demand across the residential, commercial, and luxury segments.

Property Prices to Increase in 2025

According to UAE-based developer Damac, property prices in Dubai are expected to grow by 5% to 8% annually in 2025. Key luxury areas like Palm Jumeirah and Downtown Dubai are predicted to experience even sharper price jumps.

The high demand for prime and ultra-luxury homes is also causing a shortage in $10 million+ properties. Prices in this segment are forecasted to rise another 8% to 10% next year.

Dubai’s Real Estate Boom: Not Just a Bubble

Industry analysts say the current property boom is sustainable, not just a short-term spike. The rise in demand is being fueled by real factors like:

- Strong population growth (expected to reach 4.34 million by 2027)

- An increase in foreign investors and expats

- Expanding tourism and infrastructure development

- Stable economic policies and long-term real estate strategies

Top Developers to Watch in 2025

If you’re looking to invest, here are the top developers in Dubai expected to deliver strong returns in the coming year:

- Baron

- Emaar

- Ellington

- Meraas

- Select Group

- Omniyat

These developers are known for their high-end residential and mixed-use communities that continue to attract global buyers.

Also Read: Gate Royale Residences – Luxury Living in Al Furjan, Dubai

Dubai’s Vision: AED 1 Trillion Real Estate Market by 2033

Dubai’s Real Estate Strategy 2033 is targeting a total market valuation of AED 1 trillion. The government is also investing in infrastructure projects like:

- The Etihad Rail Network

- The new Blue Metro Line

- Smart solutions to reduce traffic congestion

These initiatives will improve connectivity and add value to real estate in emerging and established communities.

Luxury Living and UHNWIs Drive Demand

Dubai is quickly becoming a global hotspot for Ultra High Net Worth Individuals (UHNWIs), thanks to the rise in luxury branded residences and investor-friendly policies like:

- The Golden Visa

- The Blue Visa

- Other long-term residency options

Today, Dubai is home to nearly 140 branded residences, offering exclusive living experiences in top-tier locations.

Tourism Boosts Real Estate and Hospitality

Tourism continues to fuel real estate demand. In 2024, Dubai recorded a record-breaking 18.72 million overnight visitors. This boom is influencing:

- Retail and shopping sectors

- Luxury and branded hotels

- Vacation rental and hospitality real estate

In fact, the 5-star hotel industry alone saw 111.8% growth in the past year, according to Cavendish Maxwell.

Final Thoughts

Dubai’s real estate market in 2024 is thriving on solid fundamentals — not speculation. With rising demand, luxury development, smart infrastructure, and favorable policies, Dubai remains one of the most attractive cities in the world for property investment in 2025 and beyond.

Whether you’re an investor, homeowner, or expat looking to relocate, Dubai’s market offers strong returns, lifestyle value, and long-term growth.